1099 unemployment tax calculator

This Estimator is integrated with a W-4 Form. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

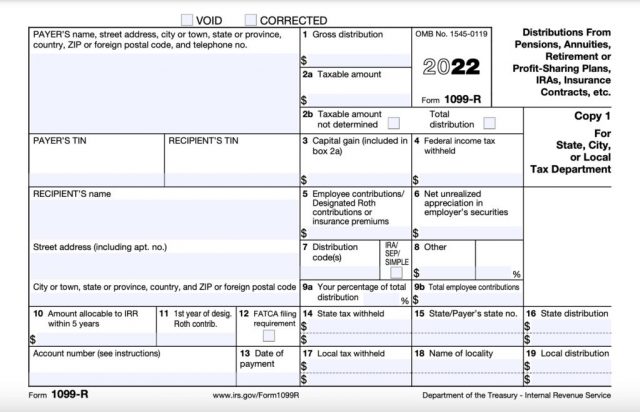

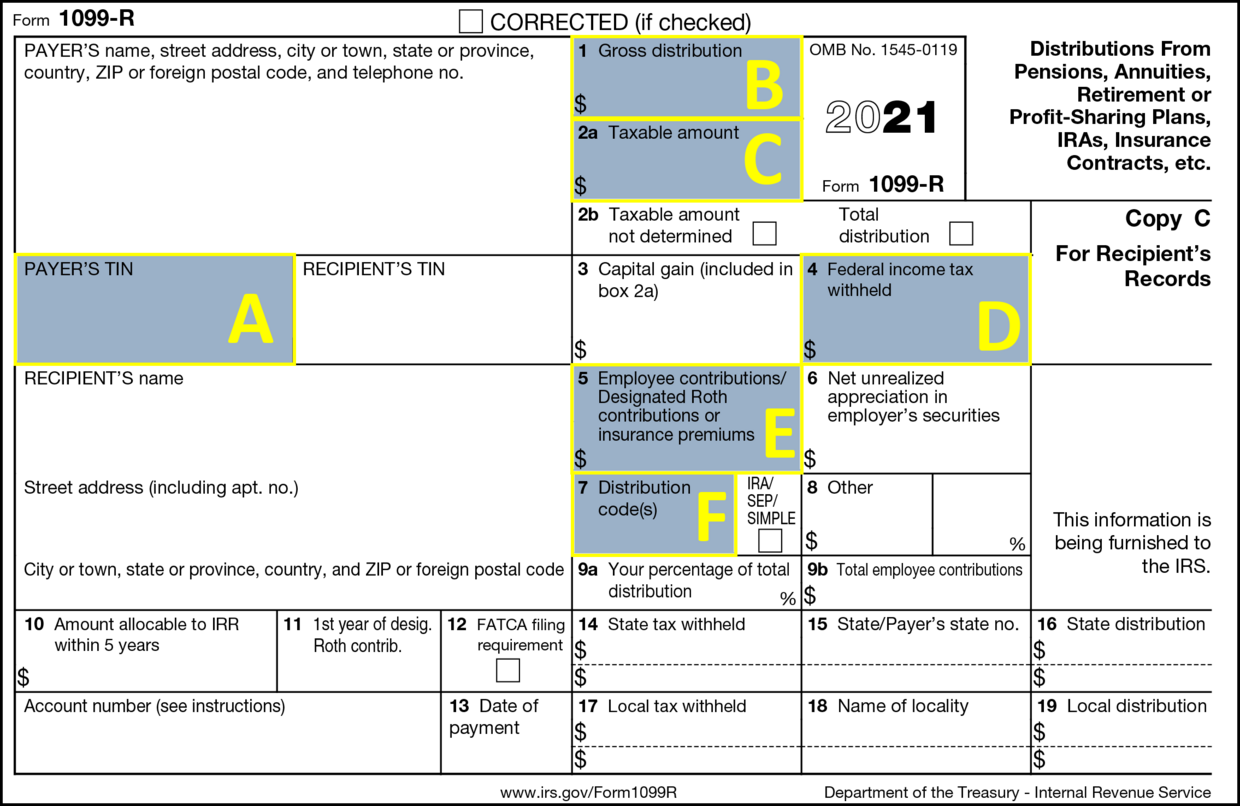

What Is A 1099 R Tax Forms For Annuities Pensions

If an adjustment was made to your Form 1099G it will not be available online.

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

. If you want taxes withheld from your weekly benefit payments you must tell us this when you file your claim. Form 1099G tax information is available for up to five years through UI Online. Ad What to know about Form 1099-NEC plus when to use it and what happens to Form 1099-MISC.

Painless1099 Calculator Income Tax Calculator Knowing how much you need to save for self-employment taxes shouldnt be rocket science. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. Form Quickly and Easily.

Pay FUTA unemployment taxes. The 1099-G tax form includes the amount of benefits paid to you for any the following programs. Work out your base period for calculating unemployment.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Import Your Tax Forms And File With Confidence. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate.

Before we jump to your questions you may want to see how your unemployment income will affect your taxes. Box 1 of the 1099-G Form shows your total unemployment. 1 Create Your 1099 Form For Free In Minutes.

The first is the 124 Social Security amount that is paid on a set amount which in 2020 will be the. Our calculator preserves sanity saves time. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income.

You can include your unemployment income in our tax calculator to get an. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. To do this you may. Employees who receive a W-2 only pay half of the total.

5 things tax pros need to know about the reporting changes with the 2020 Form 1099-NEC. 1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any. 2 File Online Print Instantly.

Ad Create Edit and Export Your 1099 Misc. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Take a look at the base period where you received the highest pay.

If you see a 0. This is your total income subject to self-employment taxes. Ad Time To Finish Up Your Taxes.

Once you submit your application we will. The California self employment tax is divided into two different calculations. Calculate the highest quarter earnings with a.

To report unemployment compensation on your 2021 tax return. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Unemployment Insurance UI Pandemic Unemployment Assistance.

Your unemployment benefits are taxable.

Easy Guide To Irs 1099 Form Types Rules Faqs Tipalti

How Do Food Delivery Couriers Pay Taxes Get It Back

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business

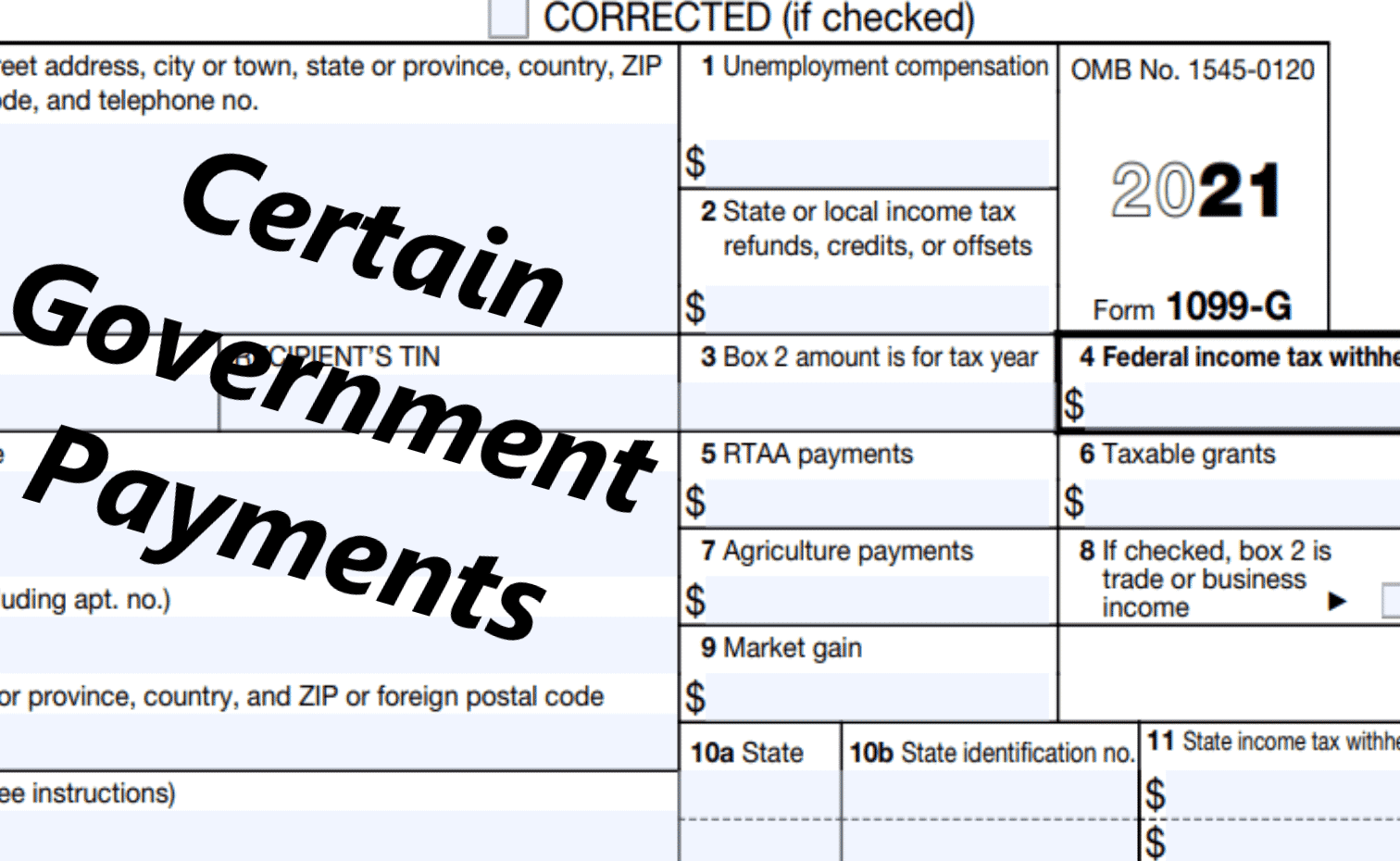

1099 G Unemployment Compensation 1099g

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 G 1099 Ints Now Available Virginia Tax

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

How Do Food Delivery Couriers Pay Taxes Get It Back

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

1099 Int Interest Income

1099 G Unemployment Compensation 1099g

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099 A Acquisition Or Abandonment Of Secured Property Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Understanding Your Form 1099 R Msrb Mass Gov

1099 G Form 2021

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping